Estimating the Fiscal Costs of Osteoporosis in Korea Applying a Public Economic Perspective

Article information

Abstract

Background

Osteoporosis and attributable fractures are disruptive health events that can cause short and long-term cost consequences for families, health service and government. In this fracture-based scenario analysis we evaluate the broader public economic consequences for the Korean government based on fractures that can occur at 3 different ages.

Methods

We developed a public economic modelling framework based on population averages in Korea for earnings, direct taxes, indirect taxes, disability payments, retirement, pension payments, and osteoporosis health costs. Applying a scenario analysis, we estimated the cumulative average per person fiscal consequences of osteoporotic fractures occurring at different ages 55, 65, and 75 compared to average non-fracture individuals of comparable ages to estimate resulting costs for government in relation to lost tax revenue, disability payments, pension costs, and healthcare costs. All costs are calculated between the ages of 50 to 80 in Korean Won (KRW) and discounted at 0.5%.

Results

From the scenarios explored, fractures occurring at age 55 are most costly for government with increased disability and pension payments of KRW 26,048,400 and KRW 41,094,206 per person, respectively, compared to the non-fracture population. A fracture can result in reduction in lifetime direct and indirect taxes resulting in KRW 53,648,886 lost tax revenue per person for government compared to general population.

Conclusions

The fiscal consequences of osteoporotic fractures for government vary depending on the age at which they occur. Fiscal benefits for government are greater when fractures are prevented early due to the potential to prevent early retirement and keeping people in the labor force to the degree that is observed in non-fracture population.

INTRODUCTION

Osteoporosis and attributable fractures are a public health burden that reduces physical activities, increases dependency on family and state support, increases morbidity and risk of mortality.[123] A growing concern from osteoporosis has increasingly been recognised in Asian countries where costs of ageing are forecasted to increase over the next few decades, placing increasing strain on health services and families.[4] Despite the enormous personal, family, and economic burden, osteoporosis screening, treatment and prevention of falls has received only limited attention from many health services.[5] To this point recent data from Korea illustrates that the annual number of osteoporotic fractures has been increasing steadily since 2008.[678]

A variety of factors are likely to influence the growing rate of osteoporosis and fracture risks in Asia of which ageing populations is considered one of the main drivers.[59] South Korea is especially concerned with ageing and age-related diseases since becoming an aged society in 2000, as the proportion of those 65 or older has reached 7% of the population.[10] To better understand the impact of ageing and to inform social and economic policies to address the needs of an ageing population, the Korean government began collecting data in those over the age of 50 through the Korean Longitudinal Study on Aging (KLoSA).[7] The KLoSA survey collects many economic and clinical parameters, some of which provide proxy measures of osteoporosis, specifically whether a person has experienced hip fracture before and the presence of fear of falling in older person.

Improving osteoporosis outcomes and preventing fractures can offer a range of patient and public benefits including a reduction of healthcare costs and contributing to active ageing and improved workforce participation in the elderly.[1112] For many years now osteoporosis and related fractures have been recognised as an important component of the active ageing agenda due to the disabling nature of fractures and resulting fear of falls that can occur.[1314] Governments are being encouraged by national patient support groups to introduce better screening measures, and many governments are actively pursuing strategies to identify and reduce the burden of osteoporosis.[9]

Policy-makers and decision-makers seek to understand the broader economic consequences of health and healthcare that are not identified using traditional cost-effectiveness approaches.[15] To understand the broader economic impact of osteoporotic fractures, we apply a public economic analytic framework that builds on previously published frameworks for estimating disability costs and lost tax revenue for government attributable to health conditions.[16] We apply a fiscal modeling approach to estimate the lifetime costs for government for fractures that are likely to occur at different ages. We apply a scenario approach based on one individual experiencing a fracture at age 55, 65, or 75. We project the “per person” costs to government in future tax revenue losses and future disability, early retirement, and health costs. The findings from this approach can be used to inform government policy for screening and treatment to estimate the likely fiscal gains from changing fracture incidence rates.

METHODS

A scenario based “per person” fiscal cost calculator model was developed for estimating public economic consequences of osteoporosis and osteoporotic fractures in South Korea. The analytic approach applied in this analysis was based on previously reported frameworks for evaluating investments in healthcare technologies for estimating disease burden from the government perspective.[1617] The calculator estimates the difference in fiscal burden between a person with osteoporosis at different ages of fracture and the average person in the general population that does not have osteoporosis, adjusted for age-specific mortality. In the osteoporosis scenarios, an individual experiencing a fracture can have an elevated risk of permanent disability compared to the general population and incur additional transfers in the form of healthcare resource use costs, disability pension, and transitioning out of work which affects one's lifetime taxes paid to government. Taxes in our model consist of direct taxes as a function of one's employment and salary, and indirect taxes which are based on consumption and value added tax (VAT) applied to disposable income.[18] A discount rate of 0.5% was applied to projected income.[19]

The comparative framework first involves constructing the average fiscal life course and then generating scenarios by which osteoporosis and related fractures influences a persons' ability to achieve the population averages. This involves modeling age-specific average work force participation, average earnings adjusted for average life-expectancy. Data were identified from a search of national databases in Korea, and the literature, for age-specific data on mortality, salary, employment, and disability. Household income by age data was acquired from Korean Statistical Information Services, which provides incomes for persons over the age of 30 by 10 year age brackets.[20]

The data on employment status was identified in the Korean Longitudinal Study of Aging survey, which gives real world data on many variables in the elderly population of Korea.[21] The survey provides real world observations on employment of middle-aged and elderly individuals in Korea (the survey population is 45 or older). Therefore, we do not assume that persons retire at a single retirement age, rather we use the observed proportion of retirement by age from the survey, to have a continuous retirement function. Old age pension and disability pension payments were based on average monthly pension payments provided in the national Pension statistics report.[22] The 3 transfers we estimate are direct taxes, indirect taxes, and healthcare resource use costs given by age strata in a study using the Korean National Health Insurance database from 2012.[23] Marginal tax rates were obtained from the Korean Statistical Information Services website.[20] Indirect tax rates were estimated applying the 10% VAT rate to disposable income rate of 82%.[24] Old age pensions below 3.5 million KRW are 100% deductible, and any pension above this deduction was taxed at the lowest marginal tax rate of 6% as pensions did not exceed the lowest tax bracket in any of our scenarios, and all pensions were adjusted for survival.[25] Disability pensions were not taxed, per Korean law.[26]

After constructing the profile of a person without any specific disease, data was obtained for patients with osteoporosis. In osteoporotic patients, there is an increased healthcare cost even before a fracture is observed.[27] These healthcare costs from Cho et al.[27], are given in a stratified format, with osteoporosis related costs of fracture and non-fracture increasing with age. There is also an increased risk of fracture which we treat as acute health events in which costs vary depending on the nature of the fracture.[28] The time of the first fracture then influences several fiscal variables such as disability status and the risk of transitioning from employment to non-employment. From this we calculate other transfers made to such a person including disability and likelihood of receiving retirement pension where one may not have received it had they continued working.[2021]

1. Fiscal model equations

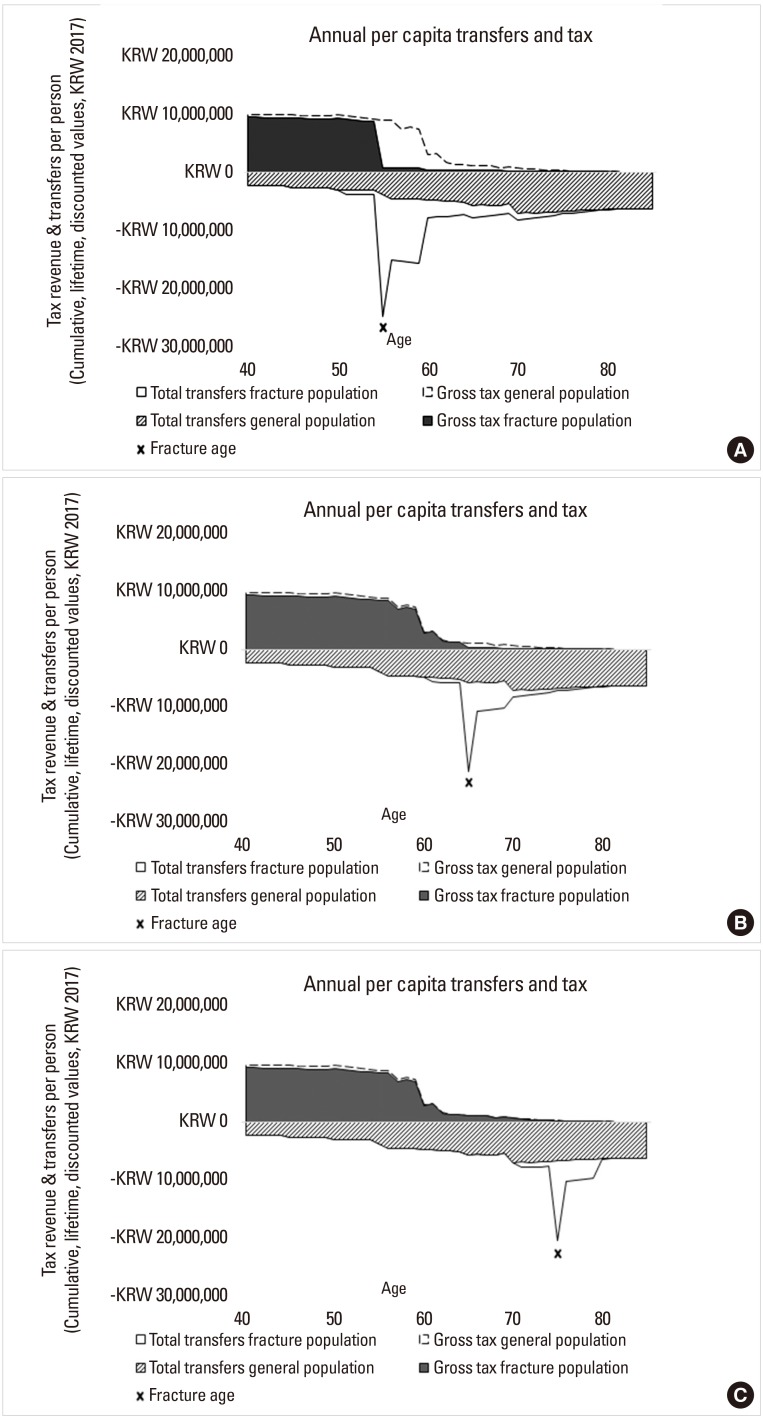

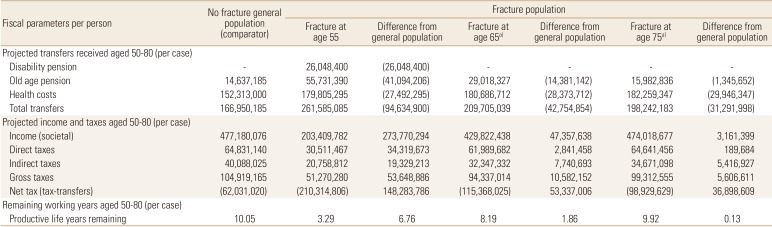

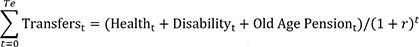

In Figure 1A–C we present per capita age-specific discounted total transfers and per capita age-specific discounted gross taxes, and in Table 1 we present the discounted net present value of total transfers and of gross taxes (Equation 1–2).

(A) Estimated transfers and taxes in a person in the general population compared to a person in the osteoporosis population, diagnosed at age 50, that has first fracture at age 55. (B) Estimated transfers and taxes in a person in the general population compared to a person in the osteoporosis population, diagnosed at age 60, that has first fracture at age 65. (C) Estimate transfers and taxes in a person in the general population compared to a person in the osteoporosis population, diagnosed at age 70, that has first fracture at age 75.

The estimated per person economic impact between the ages 50 to 80 attributed to fractures occurring at age 55, 65, and 75 compared to general population without fracture (Korean Won; 2007)

Equation 1, Total transfers:

Equation 2, Gross taxes:

In these 2 equations, t is measured in units of years, and the calculation is made over a time-period of 30 years.

We also present an outcome of net tax which can be found in Table 1. This is calculated as follows:

Equation 3, Net Tax:

2. Clinical scenarios

Previous studies have reported the impact of fractures on one's ability to work and can influence retirement decisions.[29] Because fractures can influence an individual's life course, the fiscal consequences of fractures are dependent on the severity and type of fracture, and the age at which they occur, and work status at the time of fracture. Hence, in this analysis we evaluate the impact of fractures that are likely to occur at the age of 55, 65, and 75. In the analysis described in this analysis we present 3 clinical scenarios whereby diagnosis of osteoporosis was made at age 50, 60, and 70 and a hip fracture was experienced at age 55, 65, or 75, respectively, where the prevalence of fractures varies with age, peaking between ages 65 to 74.[27] In all fracture scenarios, we estimate costs annually and then cumulatively over time between age 50 to age 80 to estimate the per person costs to government attributed to fractures at specific points in time: 55, 65, and 75. Our clinical scenarios are based on numbers for hip fractures as data is more readily available for this type of fracture.[7] Furthermore, hip fractures are often used as a surrogate for determining the international burden of osteoporosis, as they are the major event which results in fracture-related health care expenditure, as well as mortality in men, and women over the age of 50.[2] The age of osteoporosis diagnosis is dependent on guidelines for when testing is recommended, as such, it should be noted that it does not account for osteoporosis being present prior to diagnosis.[9]

For each fracture scenario the resulting impact on government transfers and morbidity attributable impact on work and future lifetime taxes paid was estimated. Upon fracture, we assume that the osteoporotic person will not return to work and will collect disability for 5 years following the year of the fracture, after which they would collect old age pension. This assumption is consistent with prior studies reporting the incidence of becoming disabled following a fracture.[28] We also assume that a person would receive old age pension, directly, if they have a fracture and stop working after the retirement age of 65.

RESULTS

The life-time estimated transfers and tax in the 3 age scenarios, comparing an osteoporotic individual with a person in the general population are shown in Figure 1A–C. In all scenarios the average annual per capita taxes paid to government between the ages of 50 to 80 were estimated. As taxes represent revenue for government, the values are expressed as positive and are shown above the x-axis in Figure 1A–C for each year. As demonstrated in Figure 1A–C, taxes are also paid in retirement as people pay taxes to government on investment income, pensions and indirect consumption taxes i.e., VAT. In the 3 age scenarios, government transfers at the individual level including disability payments, health costs and pension payments are expenses for government; hence they are shown as negative costs to government and are shown below the x-axis. In the 3 scenarios we indicate the age of the fracture with a black bar, and the resulting health costs in the year of the fracture are observed as an inverted peak.

In clinical scenario 1, the individual is diagnosed with osteoporosis early, at age 50, and experiences a first fracture at age 55, consequently there is a marked difference in taxes due to reduced participation in the labor force compared with the general population (Fig. 1A). There is also marked difference in transfers in all scenarios which is a result of taking early pension, and disability pension, as well as the remaining lifetime health care cost from diagnosis of osteoporosis. In the year of fracture there are increased health costs that shift depending on the age of the fracture. Small differences in direct and indirect taxes are observed from the 2 scenarios experiencing fractures at the age of 65 and 75 as people work longer and avoid disability compared to those with earlier fractures (Fig. 1B, C).

Table 1 shows results for 3 scenarios with varying ages of osteoporosis diagnosis and age of first fracture, for the ages between 50 and 80. The estimated old-age pension varies according to the age at which fracture occurs where those experiencing fractures at age 55 are likely to require KRW 55,731,390 compared to those with fractures occurring at age 75 with KRW 15,982,836 (Table 1). Comparing the age at which fractures occur, we also demonstrate that health costs and rehabilitation per fracture are higher in older aged persons. The total transfers received in the form of disability pension, old-age pension and health costs was highest in the scenario when fracture occurs at the age of 55 (KRW 261,585,085). We demonstrate that delaying fractures results in fewer transfers of KRW 209,705,039 and KRW 198,242,183 in fractures at age 65 and 75 compared to fractures at age 55, respectively, and the non-fracture general population is even lower at KRW 166,950,185.

Impact of fractures was estimated to influence lifetime earnings between the ages of 50 and 80 in the 3 fracture scenarios with highest earnings observed in the non-fracture population (KRW 477,180,076). Consequently, reduced earnings in the fracture populations influences the amount of taxes paid to government between the ages of 50 and 80 compared to the non-fracture general population. Gross taxes between ages 50 and 80 were lowest in those with fractures at 55 (KRW 51,270,280) compared to fractures at the age of 65 (KRW 94,337,014) and 75 (KRW 99,312,555). Avoiding fracture all together resulted in the highest lifetime taxes paid in the non-fracture population as they were able to continue working longer paying KRW 104,919,165.

DISCUSSION

The osteoporotic fracture scenarios described in our research provide insights into how a disabling fracture can influence government public spending and tax revenues between the ages of 50 and 80. Firstly, we illustrate the cross-sectorial cost consequences for government attributed to lost tax revenue, disability payments and healthcare costs that can result from an osteoporotic fracture. We illustrate the public economic impact of fractures which influences future employment for different ages at which a fracture occurs compared to the non-fracture general population. This link has been modeled based on the previously reported relationship between fractures and likelihood of retiring.[2930] Furthermore, as fractures can often lead to disability to be paid by governments, we demonstrate the likely savings that can be achieved by preventing fractures and related disability costs paid by governments compared to the non-fracture population.

In the 3 scenarios we demonstrate that the value for government changes depending on the age of the fracture and the labor participation rate of the individual. The results demonstrate that the impact of fractures in earlier ages will impact lifetime earning capacity and as a result fewer taxes paid to government as noted in those aged 55 compared to fractures at the age of 65 or 75. Furthermore, while healthcare cost savings appear in all 3 scenarios, the health costs attributed to fractures become the dominant impact on government health services in older aged cohorts that are no longer working and not able to access disability pensions that are available to those in younger ages. Again, fractures in younger cohorts are likely to have greater public economic burden as they influence disability rates and the likelihood of early retirement. In the scenario described in this analysis we demonstrate the potential fiscal impact of fracture; however, it is important to acknowledge that not all fractures will lead to disability. To align government policies in relation to promoting active ageing and maintaining a healthy work force to work into older ages might suggest improved screening for osteoporosis in younger ages could yield fiscal benefits for government. Fracture and non-fracture related health costs in osteoporosis patients have previously been reported to increase with age, a finding also reflected in our study.[27]

The model framework described in our research estimates the fiscal impact from reducing osteoporotic fractures. In all likelihood, our numbers are an underestimate of public costs as we do not include the broader impact of fractures on family members. In many instances people experiencing osteoporotic fractures will increase their dependency on family members thereby reducing the ability of relatives to participate in paid work and thus further reducing earnings and taxes paid to government by family members. As previously demonstrated in Australia, chronic diseases can reduce work activity of family members caring for another member of the family which can increase impact on government due to reduced earnings from paid employment and consequently reduced taxes paid to government while increasing dependence on public assistance for carers.[31] Moreover, previous estimates from Korea suggest that 5.7% of the overall cost burden in osteoporosis is attributed to lost work of family members caring for elderly parents.[12] A comparable nationwide study in Australia that estimated the economic burden of osteoporosis and osteopenia and related fractures in males and females over the age of 50 found that 7.8% of total costs were attributed to informal care.[32] Furthermore, a prospective study in the Netherlands of 116 osteoporotic patients, aged 50 years and older found that more than 50% of total costs of their fractures were indirect costs, and in employed patients, 81% of costs were from indirect costs, largely from variables such as sick leave.[33] Considering the proportion of indirect cost attributed to fractures would suggest the cost consequences for government are higher due to reduced taxes paid.[16]

The results described in our analysis also underestimate the fiscal consequences attributed to early mortality known to be associated with osteoporotic fractures.[34] Previously reported studies using national level data in Korea from the Health Insurance Review Assessment Service have reported excess mortality in those individuals experiencing vertebral fractures.[35] The investigators reported elevated risk of death across all age groups in subjects over age 50 after experiencing vertebral fracture compared to the general population. The risk of death was shown to increase with age and was found to be higher in males compared to females. As the scenarios described in our findings do not consider mortality as an attributable outcome, we likely underestimate the fiscal impact of early mortality in working aged subjects that can have fiscal consequences for government from reduced lifetime tax contributions.[1636]

The fiscal analysis framework illustrates that a broader range of costs can arise following fractures. These costs are mostly attributable to impacting disability status, decreased independence and in severe cases being institutionalized following a fracture.[37] While hip fracture is the most common fracture that can lead to disability, vertebral fractures and associated pain can be problematic for many individuals. The study reported by Kim et al. [38] indicated that following vertebral compression fractures many people experience disability that does not recover to pre-fracture status. Furthermore, a study in China reported osteoporotic fracture data on working aged cohorts where it was found that approximately 50% of those under the age of 60 retired early following fractures.[30] The authors also reported average lost days of work from working aged persons to be 302 days suggesting there can be short-term losses for individuals, families and companies attributed to vertebral fractures.[30]

The findings described in our research quantify the public economic impact attributable to people that withdraw from the work force following osteoporotic fractures. Although the analysis applies Korean cost data, we believe the findings described in our research are broadly applicable to other countries as there is evidence supporting the relationship between osteoporosis and related comorbidities and work force participation in Europe.[29] Furthermore, a range of health conditions can influence ones' ability to continue working; hence the lost tax revenue and disability costs could be applicable to a range of other health conditions that influence early retirement and access to disability benefits.

We believe the findings can inform policy makers regarding the fiscal benefits of fracture avoidance. Based on the scenarios described in our research there are clearly benefits to be gained from preventing fractures earlier. Whilst all fractures can give rise to health-related costs, and patient burden, preventing fractures in younger persons can have fiscal advantages for government suggesting programs to identify patients earlier will save costs in the future. This would suggest the benefits of early detection, treatment and avoidance – a policy imperative that is being pursued by only a limited number of governments.

Acknowledgments

MPC and SP were funded by a grant from Amgen Australia. The authors declare no financial interests or holdings in the sponsoring organisation. HYK received no financial grants from the sponsor and has no conflicts of interest to declare in relation to this work. The authors had full editorial control and the final determination of published material in the manuscript.

Notes

Ethics approval and consent to participate: The sources of data used in this economic assessment were obtained from a review of the literature. No clinical trials were performed, and no human or animal subjects participated in this evaluation.

Conflict of interest: No potential conflict of interest relevant to this article was reported.